Accounting Insights

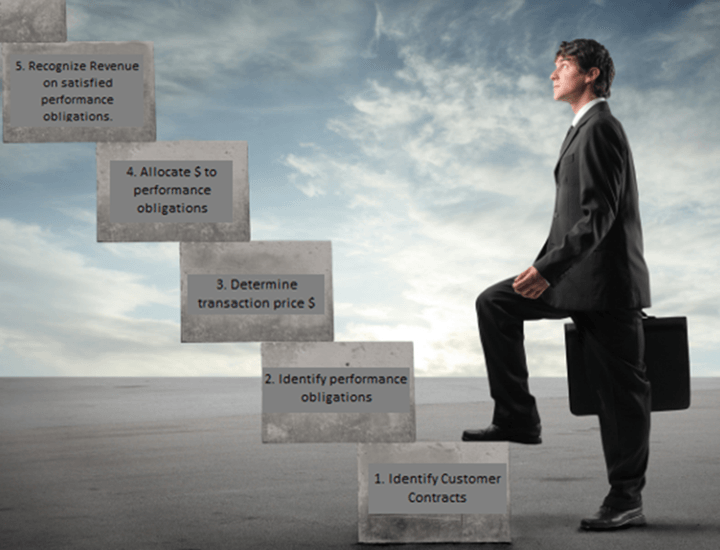

Businesses today are struggling with how to navigate or even understand the new Revenue Recognition rules. Effective beginning after 12/15/2019, all private entities are required to adhere to the FASB ASC 606 accounting Standard. This requires a lot of work by small businesses to change to this standard. There is a 5-Step Model to follow this process which sounds like a short list for success in this process, but each step requires a lot of analysis by owners, accountants, contract administrators and sales staff. Small companies may not have the bandwidth for these tasks so seeking help from an experienced consultant may help them through this process. Five Step Model of ASC 606: 1. Identify the contract with a customer. § All open contracts or legal agreements with customers that you expect to collect money from should be included. This might not be as easy as it sounds. i. First, construction contracts can traditionally involve multiple parties. ii. Second, contractors may also have multiple simultaneous contracts or change orders with the same customer that may recognize revenue under different performance obligations. § Keep in mind that under ASC 606, companies may need to consider these as one contract or segment them when there are multiple performance obligations. 2. Identify the performance obligations. Contracts and a performance obligation are not necessarily the same. Of course, each contract is based on at least one performance obligation — but many have more than one. What is a distinct performance obligation? A performance obligation is a promise to provide a “distinct” good or service to a customer. ASC 606 defines a performance obligation as a promise to transfer goods or services (or a bundle of products or services) to a customer that are either a collection of distinct goods or services with the same pattern of transfer to the customer. When there are multiple promises of transfer in a contract, companies will need to determine whether those goods or services are distinct, and therefore constitute separate performance obligations. 3. Determine the transaction price. Here, the transaction is the contract, so the “transaction price” is what the customer pays for all the contracted goods and services. A contractor might easily identify a contract’s expected revenue, but it may also involve a little math. This is the case when variable consideration is involved in the contract — such as incentives and penalties, pending change orders, and unit price contracts. As under past guidance, how businesses account for these variables depends on an assessment of the most probable final price. The determined transaction price will also factor in the impact of any significant financing which will have revenue and interest. 4. Allocate the price to the performance obligations Once the “transaction price” from step 3 is identified, the relationship of the customer contract to the separate performance obligations needs to be allocated to these obligations contained in the contract. The ASC 606 guidance has contractors do this based on the “relative standalone prices of each distinct good or service.” This is estimated as if the good or service were being sold separately. 5. Recognize revenue with the satisfied performance obligation. Businesses will only record income based upon satisfying the performance obligation. Keep in mind that the physical billing to customers does not constitute revenue – only the completion of the performance obligations will be recognized as revenue. Until the performance obligation is satisfied, it will be recognized as an Unbilled Revenue Liability on the Balance Sheet. Control is transferred when your businesses’ work becomes the customer’s to own or the service has completed. The language of the contract helps to determine when exactly this happens. For ASC 606, transfer of control happens either over time or at a single point in time. If goods or services are bundled, it may be necessary to allocate the bundle under separate estimates of that bundle if the performance obligations are different. QBOA approach In QBOA Estimates and or Sales Orders will set up all the different line items of your performance obligations. Projects can be set up so you can have multiple projects for various Customers. Items will need to be set up for this process and seeking help for these set-ups might ease your workload so that business processes can be standardized and you can get back to what you do best. For more business help with this and other QBOA questions contact https://www.momentaservices.com/ for professional certified help to your business needs.